The Energy Industry’s Evolution from 3-to-5 Corner Models

Governments worldwide are increasingly mandating electronic invoicing (e-invoicing) to streamline financial processes, ensure tax compliance, and enhance transparency. Imagine a scenario where a prominent supplier in the oilfield services sector must navigate these mandates while optimizing internal operations and bolstering supplier relationships.

Over the years, e-invoicing has undergone profound transformation, significantly impacting operational efficiency and transparency. Initially structured around the 3-corner integration model, this framework has evolved into the more complex 4-corner and, in some cases, 5-corner models. These expanded models incorporate government e-invoicing mandates and country-specific fiscal reporting requirements, adding layers of complexity and compliance challenges.

The 3-4-5 Evolution

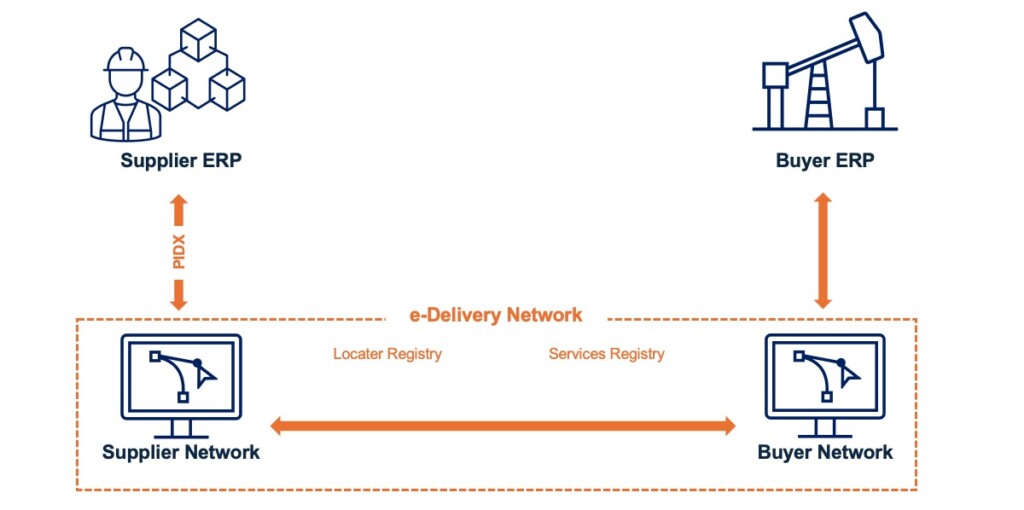

Initially, oil and gas entities relied on their respective network providers to facilitate the generation, submission, and validation of electronic invoices. In this 3-corner model these invoices detailed products, services, quantities, prices, and tax information, ensuring accuracy and compliance with industry standards. Buyers utilized similar network providers to validate and process invoices against purchase orders and contractual terms, ensuring payments aligned with received goods and services. Specialized e-invoicing platforms facilitated secure transmission and validation of e-invoices, seamlessly integrating supplier and buyer systems to automate reconciliation and payment processes, minimizing errors and accelerating transaction cycles.

While the 3-corner model represented a step forward for e-invoicing, it introduced a key risk: the supplier had no control over selecting the network. As a result, the network often imposed its standard terms and conditions on the supplier, which typically included provisions allowing the commercial use of the supplier’s intellectual property embedded in the data, along with disclaimers of liability for any breaches of agreed-upon data protection measures.

In response to these challenges, the industry evolved to the 4-corner model, which introduced separate network providers for both suppliers and operators. This shift aimed to enhance autonomy, improve data integrity, and streamline invoicing processes while maintaining higher standards of compliance and operational efficiency.

However, even with the move to the 4-corner model, risks to intellectual property persisted. Under this framework, the supplier still lacks a direct contract with the operator’s networks, leaving their data and intellectual property vulnerable to misuse by third-party service providers. To address these concerns, one potential solution is the adoption of a 4-corner interoperability framework that requires all participating service providers to adhere to policies specifically designed to safeguard both the operator’s and the supplier’s intellectual property, such as those outlined by the Digital Business Networks Alliance (DBNA).

Figure 1: The 4-Corner Model

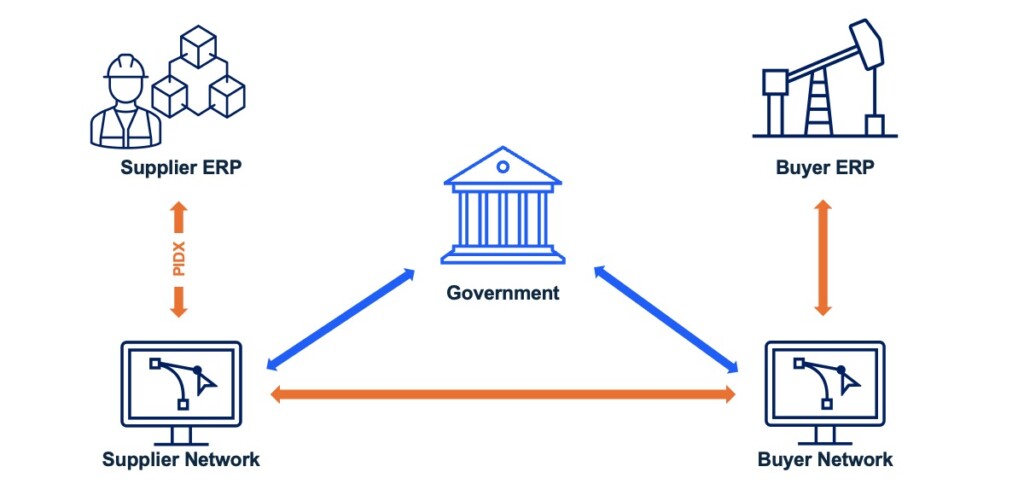

With the introduction of government e-invoicing mandates, new layers of complexity have emerged. To comply with these regulations, a fifth corner was added to the 4-corner model. This fifth corner encompasses direct e-invoice submissions to government entities, ensuring adherence to specific fiscal reporting requirements across different countries.

Figure 2: The 5-Corner Model for Fiscal & International Tax Compliance

The operational advantages of the 4-corner or 5-corner model are significant:

- Clear Process Understanding: Starting with invoice generation within the supplier’s ERP system, the e-Invoice is validated and transmitted through their network provider, helping manage timelines, expectations, and compliance.

- Standardization: Adhering to standardized e-invoicing procedures within the 4-corner and 5-corner models ensures consistency across jurisdictions and regulatory frameworks. This facilitates seamless integration with customers and enhances operational efficiency.

- Integration Points: Suppliers connect with designated network providers for secure exchange of e-invoices with customers and government entities, ensuring compliance with technical specifications, data formats, and security protocols.

- Compliance and Transparency: Following the structured e-Invoice journey ensures compliance with government mandates and fiscal reporting requirements, enhancing transparency in financial transactions.

- Efficiency: Automated validation and real-time tracking through the 4-corner and 5-corner models streamline invoicing processes, improving cash flow management and reducing administrative burdens.

Understanding and leveraging the structured e-Invoice journey within the 4-corner and 5-corner models empowers suppliers in the oil and gas industry to optimize workflow efficiency, ensure regulatory compliance, and foster collaborative partnerships with customers. This approach not only enhances operational effectiveness but also supports suppliers in navigating complexities within the supply chain, driving sustainable growth and customer satisfaction. So, how does it really work?

Journey of an e-Invoice: An Illustrative Example

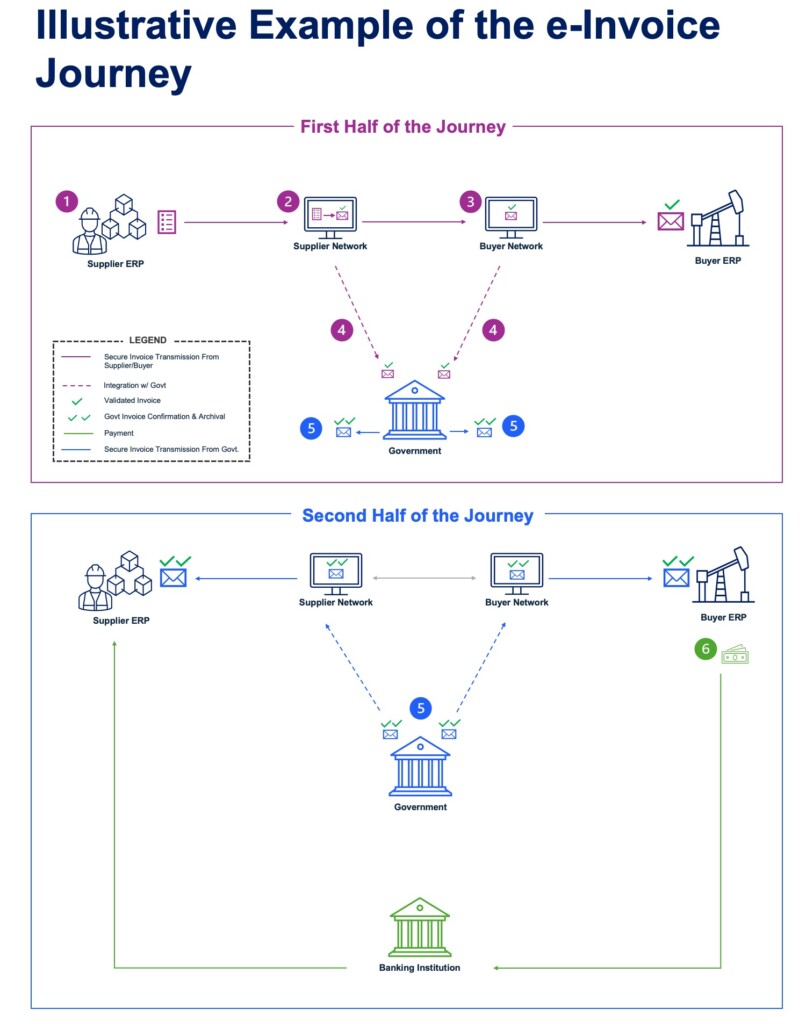

To navigate the complexities of international government fiscal reporting, suppliers strategically adopt the 5-corner model. This framework integrates governments, businesses, service providers, intermediaries, and consumers, facilitating secure electronic exchanges. For example, a supplier implements e-invoicing across multiple countries, leveraging standardized processes for efficient regulatory compliance.

Figure 3: Illustrative Example of the Tax Compliant e-Invoice Journey

Here’s how the journey of an e-Invoice unfolds from the supplier’s perspective to its final destinations in the operator’s network and government’s network:

- Supplier Initiates e-Invoice: Generated within the supplier’s ERP or invoicing system, containing detailed information on goods delivered or services rendered.

- Submission to Network Provider: Connected to the designated network provider, ensuring e-Invoice compliance with industry standards before transmission.

- Transmission to Operator’s Network: Validated e-invoice transmitted to the operator’s network provider, facilitating a seamless and secure data transfer.

- Integration with Government’s Network: In mandated jurisdictions, integrated with the government network, ensuring fiscal reporting compliance and secure submission to relevant tax authorities.

- Confirmation and Archival: Receipt confirmation for both parties, facilitating financial record reconciliation and audit compliance.

- Payment and Financial Closure: Approved e-Invoice terms lead to supplier payment and financial transaction closure.

Growing Government Mandates

These mandates aim to standardize and secure invoicing processes, enhance tax compliance, and streamline operations within the energy industry across different regions globally. Each country’s e-invoicing system may have specific requirements and timelines for implementation, influencing how businesses in the Energy Industry adapt to electronic invoicing practices.

Countries that have already implemented fiscal reporting requirements includes*:

- Argentina’s AFIP (Administración Federal de Ingresos Públicos)

- Brazil’s NF-e (Nota Fiscal Eletrônica) and CT-e (Conhecimento de Transporte Eletrônico)

- Chile’s DTE (Documento Tributario Electrónico)

- Colombia’s DIAN (Dirección de Impuestos y Aduanas Nacionales)

- Costa Rica’s FEL (Factura Electrónica)

- Italy’s FatturaPA (Fattura Elettronica alla Pubblica Amministrazione)

- Mexico’s CFDI (Comprobante Fiscal Digital por Internet)

- Norway’s EHF (Elektronisk Handelsformat)

- And many others…

In process of implementation as of this publication*:

- European Union’s Directive 2014/55/EU for public procurement

- India’s GST e-invoicing system

- Indonesia’s eFaktur

- Peru’s Factura Electrónica

- Portugal’s Fatura Eletrónica na Administração Pública (FE-AP)

- Spain’s FACeB2B for public administration

- Sweden’s Svefaktura for public procurement

- Turkey’s e-Arşiv Fatura

- Uruguay’s eFactura

*For more information about each country’s mandates, please visit their official websites. You can also subscribe to alerts for country-specific fiscal reporting compliance requirements through the OFS Portal’s government e-invoice service provider, Edicom and Pagero.

All government mandates that are already, or are planned to be in effect, share common features, yet they differ in scope, specific requirements, and the regulatory oversight. This makes it even more crucial for suppliers to adopt a unified invoicing model. With the 5-corner e-Delivery model, suppliers easily submit e-invoices in a standardized format, leveraging their network providers to handle formatting according to each country’s unique regulatory requirements seamlessly. This approach ensures compliance across diverse jurisdictions while streamlining the invoicing process for suppliers.

Differences that Present as e-Invoice Submission Efficiency Challenges

- Scope differences because some mandates apply broadly across all transactions (e.g., Mexico’s CFDI), while others are specific to sectors like public services (e.g., Italy’s FatturaPA).

- Transaction types have varied coverage including goods sales, services, digital products, and sectors like transportation (e.g., Brazil’s NF-e and CT-e).

- Compliance requirements such as data fields, validation processes, and reporting timelines differ between mandates.

- Regulatory oversight where each mandate is overseen by a different regulatory body, impacting enforcement and regulatory updates.

- Integration Challenges where suppliers may face integration issues due to differences in technical specifications, data formats, and regulatory changes across jurisdictions.

- The ever-evolving nature of the integration specifications indicating that a go-live is not necessarily the end of the journey (e.g., Colombia’s regulation is on its third iteration)

Scale Up to Keep Up as Mandates Continue to Roll Out

The journey of an e-Invoice from its creation by the supplier to its destination in the operator’s and government’s networks highlights the pivotal role of e-invoicing in modern supply chain operations. By harnessing advanced network providers and adhering to government mandates, suppliers and operators elevate efficiency, transparency, and regulatory compliance in their financial transactions. With the 4-corner model already integrated into the government-mandated 5-corner framework, suppliers can swiftly extend its implementation across their entire network of operators, enhancing both operational and integration efficiency.

While some countries are actively preparing and implementing their e-invoicing mandates, others, like the United Kingdom, are collaborating across industries to establish public policies. These efforts aim to create clear guidelines that enhance coherence and maximize the benefits of streamlined e-invoicing.

Explore International Fiscal Reporting Capabilities

Suppliers leverage standardized e-invoicing processes to efficiently fulfill country-specific mandates. If you’re interested in learning how we assist suppliers in the energy industry to transform their B2B invoicing practices and navigate global regulatory landscapes effectively through our International Tax Compliance & Government Fiscal Reporting capability, please complete and submit the inquiry form below. For additional resources covering supply chain digital trends, check out our latest 4 Smart Trends in Energy Supply Chains white paper.